Fractional Investing: The Emergence of Dematerialised Real Estate

Table of Contents

- Introduction

- The Promise of Fractional Investing

- The Premise: From Concept to Evolution

- The Author’s Reflection

Introduction

Premium Real Estate as an Asset Class in India — Grade A office spaces, premium retail properties, and high-end commercial developments have been esoteric to institutional investors and the ultra-wealthy.

However, fractional ownership erases these traditional capital barriers, ushering in a new era where indie investors and the common man can access prestigious properties with investment thresholds as low as 200 INR.

The Promise of Fractional Investing

Imagine owning a piece of premium office space in Mumbai's Bandra Kurla Complex or a stake in a luxury holiday home in Goa — all with an investment that's a fraction of the property's total value. That's the reality fractional real estate investing is bringing to India's growing investors.

Fractional ownership splits a property's cost among multiple investors, each owning a percentage of the asset. This innovative approach offers:

-

Access to premium real estate with lower capital requirements

-

Professional property management without hands-on involvement

-

Potential for both rental yields and capital appreciation

-

Reduced risk through shared ownership

For those intrigued by this revolutionary approach to real estate investment, here is a resource to dive deeper:

The Premise: From Concept to Evolution

REITs or Real Estate Investment Trusts

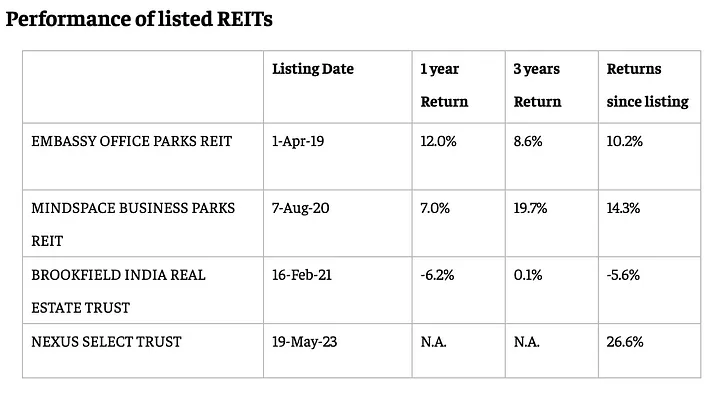

Real Estate Investment Trusts (REITs) marked India’s first formal step toward democratizing real estate investment. These regulated investment vehicles primarily focus on commercial office spaces, offering investors a way to participate in India’s booming commercial real estate sector.

REITs bring several advantages to the table:

-

High liquidity through stock exchange listing.

-

Regular income through mandatory dividend distributions.

-

Professional management.

-

Regulatory oversight ensures investor protection.

The Nature of REITs: Chapter IV of the REIT Regulations outlines the key requirements for listing a REIT through an Initial Public Offering (IPO), including:

-

A minimum Market Asset Value (MAV) of INR 5 billion

-

At least 200 unitholders

-

A minimum offer size of INR 2.5 billion

This means that REITs exclude significant segments of the real estate market, ranging from mid-sized office spaces to residential properties and vacation homes that do not fit the scope.

Limitations:

-

Small Scope: It only enables a very small subset of premium capital-intensive real estate assets, such as office parks, tech parks, etc.

-

Limited Asset Diversification: Investing in a REIT does not provide control over specific properties or regions. The decision-making authority remains with the REIT manager.

While you can choose to invest in a particular property class, such as office parks, you cannot selectively target individual properties or regions for investment for example, ‘Bagmane Solarium in Whitefield, Bengaluru’.

Beyond REITs: The Evolution of Fractional Ownership

The limitations of REITs sparked innovation in India’s real estate sector. A new breed of companies emerged, creating novel fractional ownership structures for various property types.

These structures utilize sophisticated legal frameworks involving Special Purpose Vehicles (SPVs), Compulsory Convertible Debentures (CCDs), and Lender Independent Engineers (LIEs).

Let’s break this down:

An SPV acts as a separate legal entity holding the property, with investors owning shares in the SPV rather than the property directly. CCDs provide a structured way to convert debt into equity, offering flexibility in investment terms. LIEs ensure professional oversight of property management and maintenance.

Companies like ALYF (focusing on holiday homes), hBits and Strata (commercial properties), and Alt DRX (diverse real estate assets as tokens) are pioneering this space.

The MOAT:

- Providing a legal layer that establishes trust outside of government regulation.

- Enables you to invest surgically in specific properties that you believe can offer you growth provided the fractional platform offers the property listing.

However, these structures own their challenges:

- Regulatory uncertainty

- Relatively high investment thresholds(Does not hold for Alt DRX).

- Limited Liquidity Compared to REITs: While REITs have effectively addressed liquidity challenges in real estate, companies offering legal frameworks to replicate REIT-like structures for other real estate assets like holiday homes, and residential properties, do not yet provide the same level of liquidity.

- Liquidity Gap to Persist: This liquidity discrepancy should hypothetically continue until the concept matures and transaction volumes increase, enabling greater liquidity in these emerging real estate investment structures.

The Game-Changer: SEBI’s SMREIT Framework

Recognizing the need for a regulated framework for smaller real estate investments, SEBI introduced Small and Medium REITs (SMREITs).

This groundbreaking structure addresses the limitations of both traditional REITs and startup-led fractional ownership models.

Key features of SMREITs include:

-Lower minimum asset value requirement (₹50 crores vs ₹500 crores for regular REITs). -Multiple scheme structure: Existing REITs operate with a single pool of investor money, with all assets forming one portfolio. In contrast, SM REITs can launch multiple schemes, each with its own set of assets and unit holders, similar to mutual funds. This concept is inherent to the fractional investing startups mentioned earlier in the article.

Example: An SM REIT might have:

Scheme A investing in office properties in Mumbai.

Scheme B focused on retail spaces in Delhi.

Scheme C deals with warehouses across India. Each scheme would have its own investors and asset pool.

- Clear regulatory framework.

- Potential for greater liquidity.

Here’s SMREITs Official Document which explains the entire dynamic shift elaborately.

The Future: Tokenization and Beyond

The most exciting development in this space is the emergence of the tokenized real estate market.

Alt DRX is creating digital marketplaces where real estate tokens can be traded, potentially solving the liquidity challenge that limits startup-led fractional ownership.

The Author’s Reflection

-

Comparison to mutual funds: While there are parallels between fractional investing and mutual funds, there are fundamental differences in the dynamics.

-

In the case of mutual funds, the fund manager has no control over the potential or growth of the portfolio, while in this case, the REIT manager or equivalent is a major driver of the growth of the stocks.

-

The right REIT managers are not just distributors of stocks, but also those who can operate real estate more efficiently.

Efficient management of properties will drive better margins, which will drive better returns for the investor.This means that established real estate players who understand the ins and outs of property development and management have an intrinsic motivation to be better REIT managers as well.

-

-

Fractional Investment Providers: For startups that provide a legal structure to invest fractionally in selected lower capital properties, operations are ever so paramount.

- From an investor's point of view, some of these providers also democratize operational decisions to the investors.

For example, you will be part of operational decisions of properties you fractionally own. This is again specific to certain providers and not all of them.

- This indicates a gap in technical innovation where such operational decisions are recorded truthfully and the legal nuances surrounding such operational democracy are automated.

-

Real Estate as a status driver: Luxury has been the zenith of real estate. With fractional investing, India II and India III are now incentivized to consider a dematerialized version of real estate to invest.

- It will be interesting to observe how this shifts the motivations around luxury real estate purchase patterns with the change in demographics and financial class ratios.

-

With emergence of any asset class, there will be an emergence of data. With all the new options, people will be needing data points to help drive decision-making.

- It will be interesting to see new data companies providing for such use cases.